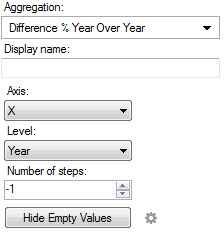

- #Year over year difference percentage of grandtotal spotfire update#

- #Year over year difference percentage of grandtotal spotfire plus#

- #Year over year difference percentage of grandtotal spotfire free#

I can be there for him without any competing obligations. It takes a lot of time, but I'm grateful that I have that time. Now that school is back in session, I walk him to school, read books and do Legos with him, and help with his homework.

Over the summer, I repainted his room, took him to the beach, took him on hikes, and spent many hot days at the pool. While she's working, I'm the stay-at-home dad to our son. If she wants to join me in retirement next year so we can travel more, or if she wants to keep working a while longer and let our net worth grow, both those options are perfectly fine with me. I've done my best not to pressure my wife either way. I was planning to withdraw between 2.5% and 3%, which should survive a dip like this, but I'm not upset about not having to put that to the test just yet. I'm down about $400,000 from my all-time high, but I'm not stressing at all.

#Year over year difference percentage of grandtotal spotfire plus#

Her salary plus the dividend payouts from my taxable account cover our expenses, plus we get that sweet employer-paid health insurance. Her job is easy, low-stress and 80% working from home, and she wants to keep working at least until the stock market recovers. But then the markets dropped, and she didn't like the idea of giving up her paycheck while our net worth was decreasing. The plan was for my wife to quit in 2022. OK, let me put this out there to start with: I'm a complete fraud.

#Year over year difference percentage of grandtotal spotfire update#

Technically, this one-year update is a little late, but I have an excuse: I've been having too much goddamn fun! I FIREd last July with $2.3M in investments, zero debt and a paid-off place. As is tradition, I'm back to fill you in on how it's been going.īasic details: 39M at retirement, 40 now. Greetings, FIers! I retired in summer 2021.

#Year over year difference percentage of grandtotal spotfire free#

Please read the FAQ and Rules above, then feel free to share your journey or ask for advice! When participating on this subreddit, please be mindful of the ways in which you are lucky. Taking the slow road, or the traditional road to retirementīecoming financially independent requires hard work and a healthy attitude towards money, but also a degree of privilege. Gaining wealth for the purpose of excessive consumption Investing to make your money work for you, and learning to manage/optimize those investments for the unique nature of FI/RE Striving to save a large percentage (usually more than 50%) of your income to accelerate achieving FI Working to increase your income and income streams with projects, side-gigs, and additional effort

Your wants and needs aren't written in stone, and less spending is powerful at any income level. Simplifying and redesigning your lifestyle to reduce spending. The purpose of this subreddit is to discuss FI/RE strategies, techniques, and lifestyles whether you are retired or not.ĭiscovering and achieving life goals: “What would I do with my life if I didn't have to work for money?" This subreddit deals primarily with Financial Independence, but additionally with some "RE" concepts.Īt its core, FI/RE is about maximizing your savings rate (through less spending and/or earning higher income) to achieve FI and have the freedom to RE as soon as you wish. This is a place for people who are or who want to become Financially Independent ( FI), which means not having to work for money.īefore proceeding further, please read the Rules & FAQ! Rulesįinancial Independence is closely related to the concept of Early Retirement/Retiring Early ( RE) - quitting your job/career and pursuing other activities with your time.

0 kommentar(er)

0 kommentar(er)